Keep Calm and Revisit your Financial Plan

August 14th was a tough day if you are invested in stocks. We all hate days like the ones we saw last week, its seems like no matter what you are in, you “lost” money. Here are a few things you should do before hitting sell.

Revisit your financial plan.

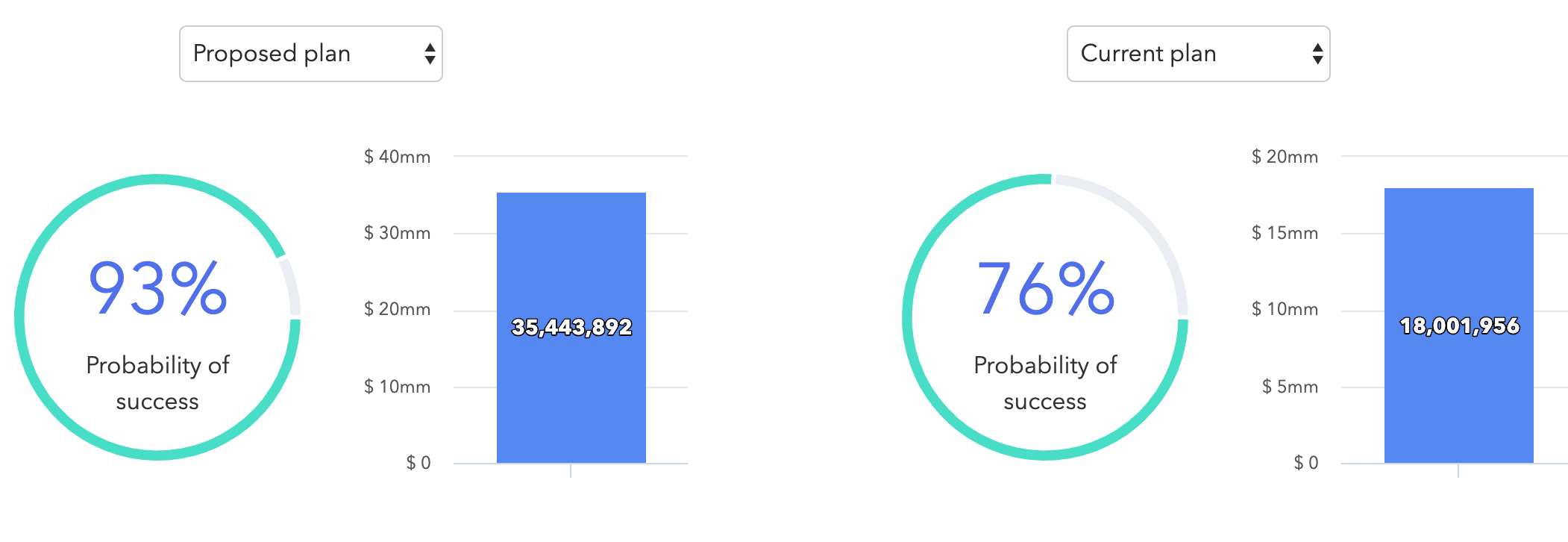

You made a plan for a reason. More than likely your financial planner has “stress tested” your plan to see what might happen in the event of a market downturn like this one, or one worse than this. It’s important to discuss your goals and let your planner know what you would like to do and honestly assess the cost to see what is the probability of success for your plan. Many times the probability of success is a sampling of a monte carlo simulation to give you a good idea how likely you are going to be able to do all the things you both need and want to do in life. This can be a scary time if you are getting ready to retire or make a life change where you will likely tap into some of the invested funds.

In my empirical research, I have often seen it more detrimental to someone’s overall financial picture to start spending more not preparing by not saving enough to begin with. A CERTIFIED FINANCIAL PLANNER™ professional can help show you what will make the most difference in your financial plans, despite small market drawbacks.

Remember: Drawdowns are normal.

Not only are they normal, they are healthy.

Each of the red dots mark the “bottom” for that year, In other words, the low water mark, or the worst it got that year. Where the bar end with a number is how that year ended; for this year, it’s indicating information for 2019 as of August 13th. All numbers are for the S&P 500 index.

As we can see, every year has a red dot, meaning pullback like what happened on August 14th is completely normal and part of the equity markets.

Are you diversified?

This might seem like a no-brainer “don’t put all your eggs in one basket”, and if you only bought the S&P 500, that might not be a great idea all of the time.

Asset class returns can vary widely from year to year. Thus, if done correctly, diversification can help “smooth out” an otherwise bumpy ride. As you can see from the chart above, it’s not going to win first place often, but it’s seldom last.

In fact, I’d go so far as to say it’s days like August 14th that can divide a successful investor and an unsuccessful investor. As you can see from the chart to the right, the average investor only achieves a 1.9% return on average, not even beating inflation, let alone the S&P 500 or a balanced portfolio between stocks and bonds.

Why? A large part is because people panic and sell when prices are low because they fear their investments are going to keep declining. It’s important to keep your perspective of where you started and where you are in comparison to where you want to go.

If you want to dive into the real nitty-gritty of this, compare your money-weighted returns against your time-weighted returns. The main difference is that the money-weighted return is influenced by the timing and amount of funds going into and coming out of an investment. It reflects what an investor is likely to calculate as their personal return. A time weighted return is the same for all who started and stopped on the same dates.

Days like August 14th are stark reminders that investing is not for the faint of heart. Investors globally constantly replay the events of the global recession from 2008-2009 when they see days like today. While there is merit to that, today is more likely to be a day that separates the investors who can stomach the volatility from those who need to deploy capital in less volatile places while knowing they might not get the same return.